International and domestic banks in Vietnam are gearing up to boost their e-Know-Your-Customer (eKYC) process to provide customers with a seamless onboard experience and reduce paper-based procedures. The State Bank is also urgently completing a legal corridor to promote this activity. From July up to now, many banks have implemented eKYC solution and obtained outstanding results.

It’s important to implement eKYC solution because the process of attracting new customers is the bank’s first chance to win them over and pave the way for the entire relationship to move forward.

Benefits of eKYC in the digital onboarding process for banks

The eKYC solution can bring benefits for the bank

The eKYC solution can bring benefits for the bank

1. Instantaneous

The eKYC service is completely automated online. This means that KYC data can be transferred in real-time without the need for any manual intervention. The paper-based KYC process can take days up to weeks to get verified, but the eKYC process takes just a few minutes to verify this issue.

2. Reduce failed client acquisition and acquire new customers

According to The Digital Banking Report (2017), there is 43% of those with low levels of satisfaction during the process of opening a new account indicates that they will be sure or able to switch banks because they have to enter information more than once, especially when moving from this channel to another channel, not near real-time and the accuracy is not high.

Therefore, eKYC is one of the optimal solutions to overcome the above limitations. It makes the onboarding process of banks a unique process, no matter how many channels they use, at any time. Guaranteed information is updated and synchronized across channels to assure customers that they have access to the data is always accurate everywhere.

3. Implement eKYC solution to reduce fraud

Reducing fraud is one of the notable advantages of the eKYC solution

Reducing fraud is one of the notable advantages of the eKYC solution

As banking transactions have shifted onto more digital and mobile platforms, digital onboarding process fraud has emerged to take advantage of the system. As technology advances, banks will have more and more resources that develop in order to help them battle fraudsters such as eKYC in the digital onboarding process for banks.

Instead of only authenticating users at the point of logging into an account, systems continuously monitor accounts and verify that users are not behaving strangely. One way of conceptualizing how continuous authentication might work is through a scoring system “which measures how certain it is that the account owner is also the one using the device”. These technologies include OCR, facial recognition, liveness detection and fraud detection. This way helps banks increase security for their system and reduce fraud in the digital onboarding process.

4. Improve customer experience

According to Signicat (2019), 40% of consumers abandon banking onboarding processes as a result of the time needed to complete the required steps, or the need to provide too much personal information.

In addition, when asked if a 100% online onboarding process, including identity verification for eKYC, would encourage more applications, 55% of all respondents said they would be more likely to apply. Over half (52%) would buy additional services if paper-based identity was not needed. It shows that eKYC in the digital onboarding process helps banks to improve customer experience. Consumers want to move to digital, to be able to verify their identity online and accelerate the onboarding process.

Read more: ” 8 Benefits Of eKYC In Digital Onboarding Process For Banks “

More Vietnamese banks implement eKYC solution

On November 14, 2019 Government issued Decree No.87/2019/ND-CP amending Decree No.166/2013/ND-CP detailing the implementation of Anti-money Laundering regulations, including allowing Ekyc, which will enable a transformation to digital banking. With Article 8.2(a) of this Decree, for the first time, financial institutions (also known as accounting subjects according to the Law on Anti-Money Laundering of Vietnam) can choose to offer either or both face-to-face or eKYC onboarding. Previously, only face-to-face onboarding was allowed.

Since the beginning of July 2020, the State Bank has allowed about 10 joint-stock commercial banks to pilot eKYC application in operations with the requirement to ensure risk safety, when a situation occurs, commercial banks must be solely responsible. Names are VietCapital Bank, NCB, Nam A Bank, CIMB, MBBank, VIB, LienVietPostBank. And, in the first steps of implementing eKYC solutions, they achieved many positive achievements.

Launched from the beginning of July this year, after only 2 months, VPBank, the first unit in the eKYC application industry, had approximately 15,000 new registered accounts, equal to 50% of the estimate for the whole year 2020. Besides, it is estimated that this year there will be about 30,000 new customer accounts registered via eKYC.

VPBank is the first unit in the eKYC application for this industry

VPBank is the first unit in the eKYC application for this industry

Or at HDBank, after 1 month of implementation from August 1, the eKYC method on HDBank App has attracted nearly 15,000 registered customers. Statistics show that 40% of customers conduct online transactions on HDBank’s digital banking platform regularly, increasing the transaction rate by 25% compared to the months before eKYC is deployed.

TPBank is also one of the first banks in Vietnam to successfully implement eKYC solution and receive certain results. After 1 month of implementation since the beginning of August, TPBank said the bank has successfully processed nearly 30,000 new registrations through the method of opening online accounts and identifying eKYC customers.

eKYC holds a key position in digital banking transformation, a fundamental service and an inevitable step in this digital age. In addition to saving time and having a better experience for customers, this solution is bringing high efficiency to banks, helping banks to reduce human resources and costs. But preparation is needed to optimize the process for banks to lead the trend and go on the digital wave to win new customers and make money from existing ones.

The eKYC solution provider for banks:

Innotech Vietnam with more than 12 years of experience in software development for companies around the world. ITV focuses on developing platforms and solutions that help businesses accelerate digital transformation, improve competitiveness, spend more time focusing on developing their business models.

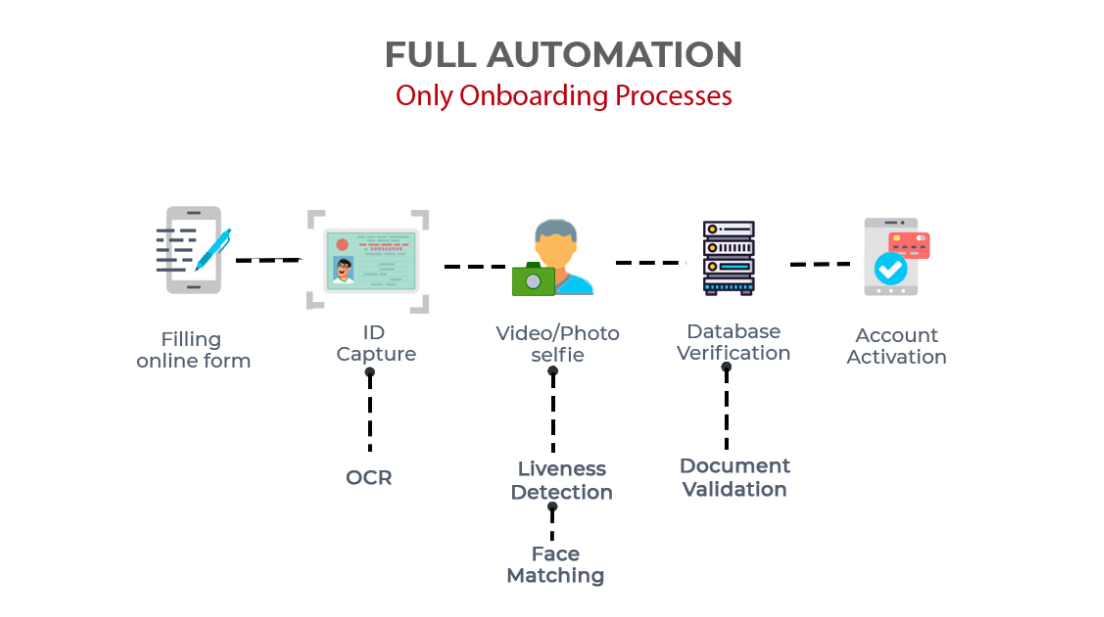

Innotech Vietnam is confident to be the leading eKYC solution integrator in Vietnam for the banking industry. We apply many advanced technologies such as OCR, Facematching, Liveness Detection, Fraud Detection, .. which helps banks implement eKYC solution more accurately.

The eKYC process was developed by Innotech Vietnam for banks

The eKYC process was developed by Innotech Vietnam for banks

With experience in consulting and implementing eKYC solution for many banking, finance and securities companies. Innotech Vietnam hopes to develop the eKYC solution that is most suitable for your business.

The eKYC solution developed by Innotech Vietnam

GET A QUOTE

Do not hesitate to contact us immediately to experience the Demo: [email protected]