Innotech Vietnam summarizes 5 Challenges for digital banking. Digital banking challenges refer to factors that are preventing digital banking from stabilizing and becoming a universal banking method for everybody.

1. Security

This is one of the first things that comes into one’s mind when keeping money is mentioned anywhere. It is, however, sad to say that hackers are still giving financial institutions a run for their money. Therefore, some customers are not willing to take any chances. Note that banking security is nothing like downloading and installing an antivirus.

2. Internal barriers

For banking to be fully digitized, it means that both the banking system and employees will have to undergo a cultural shift. However, it is good to know that unlike other businesses, banks have a unique way of departmentalization, and this greatly influences the level of technology to be used. While some department will benefit from a digital banking system, some departments will have to lay off some employees. Also, employee training may be required.

3. Upgrading of systems

A challenge across vertical segments includes technology that is generations old. In certain areas of the business, these outdated assets need to be updated, upgraded or completely replaced in order to meet market challenges, customer needs, and emergent competitors.

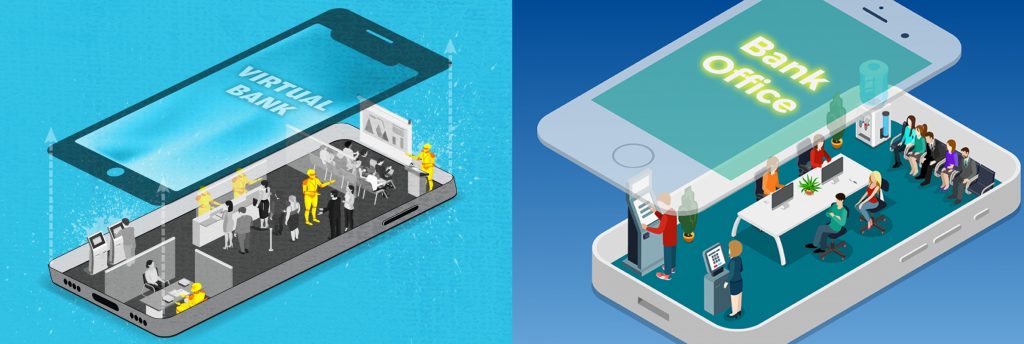

4. Brick and Mortar, Virtual, or Both?

Different generations want to handle their financial well being differently. Some want to be able to meet with a person face-to-face while some want to do everything virtually. And then there are some that like to make simple transactions on their phone, but would still like to meet with a real-life person for things like obtaining mortgage loans or discussing investment opportunities. As a response to this challenge, financial institutions are changing the way that they do business. Brick and mortar locations are still important to the success of the bank, but financial services institutions must also modernize and create digital workplaces that resonate with all the variations of the customer. Having a complete, omni-channel strategy is an absolute necessity. The challenge is creating a great one.

5.To buy or build the banking system

With the demand for digital banking on the high, some banks are desperate to take the leap and adopt digital banking. However, most banks are not quickly adopting digital banking because they don’t know which kind of system will work correctly. Some prefer purchasing such systems because they want to work with a system that has been tested. Others prefer having a system built specifically for them. Don’t forget that both kinds of system have their pros and cons.

Solutions for Bank to overcome these challenges above:

Partnering with an experienced financial services technology solution provider to plan, implement and execute the bank’s digital transformation initiatives makes the seemingly daunting task of transforming much more manageable.

Did we miss anything? Let us know in the comments what challenges your financial institution might be facing.

Contact experts at Innotech Vietnam for any questions about Software outsourcing for Fintech!

Email: [email protected]