Today, fintech is not a strange term for many people in banking and finance. In this article, we will introduce all you need to know about fintech—financial technology.

More information: Phát Triển Phần Mềm Fintech

What is fintech?

Fintech, or financial technology, is defined as any technological innovation in financial services. Industry participants develop new technologies to disrupt traditional financial markets. Larger corporations are increasingly recognizing the need for software solutions. So, they turn to fintech to increase and improve their financial services.

The fintech sector experienced remarkable growth from 2012 to 2021, encompassing a pace between 2012 and 2021, including adoption rates and the number of fintech start-ups. The largest market will be digital investment, with an AUM of US$116.20bn in 2023. In the digital payments market, the number of users is expected to amount to 5,480.00 million by 2027.

Who are the target groups of financial technology?

A traditional financial market will consist of two parties: financial institutions (banks, investments, insurance, securities, financial companies, etc.) and customers. And fintech will consist of 3 parties, keeping the interaction relationship:

Fintech company:

These are independent companies specializing in information technology and providing new products and services in finance. Customers of fintech companies may also be end-users and may also be financial institutions.

Financial institution:

This is an important entity in the financial industry. Because of the importance of technology, institutions increasingly collaborate extensively with fintech companies. On the other hand, these institutions also directly invest in fintech companies or research activities. Since then, institutions have embraced new technology to dominate the market.

Vietnam State Bank is a financial institution

Vietnam State Bank is a financial institution

Customer:

Customers are users of financial services products. In the fierce competition between institutions or companies, customers get more benefits.

The main products that financial technology bring

Based on the target users, the products in fintech are divided into two different groups. Include:

Group 1:

It’s products for consumers. The goal is to improve the way individuals borrow, manage money, and fund startups. It makes people’s lives easier and faster.

Group 2:

It’s a back-office technology product. This product group supports the activities of financial institutions as well as fintech companies.

In fact, services are provided such as lending, money transfer, payment,… Fintech also offers many more extensive services, such as peer-to-peer lending, crowdfunding, personal finance, data management, insurtech, crypto blockchain,…

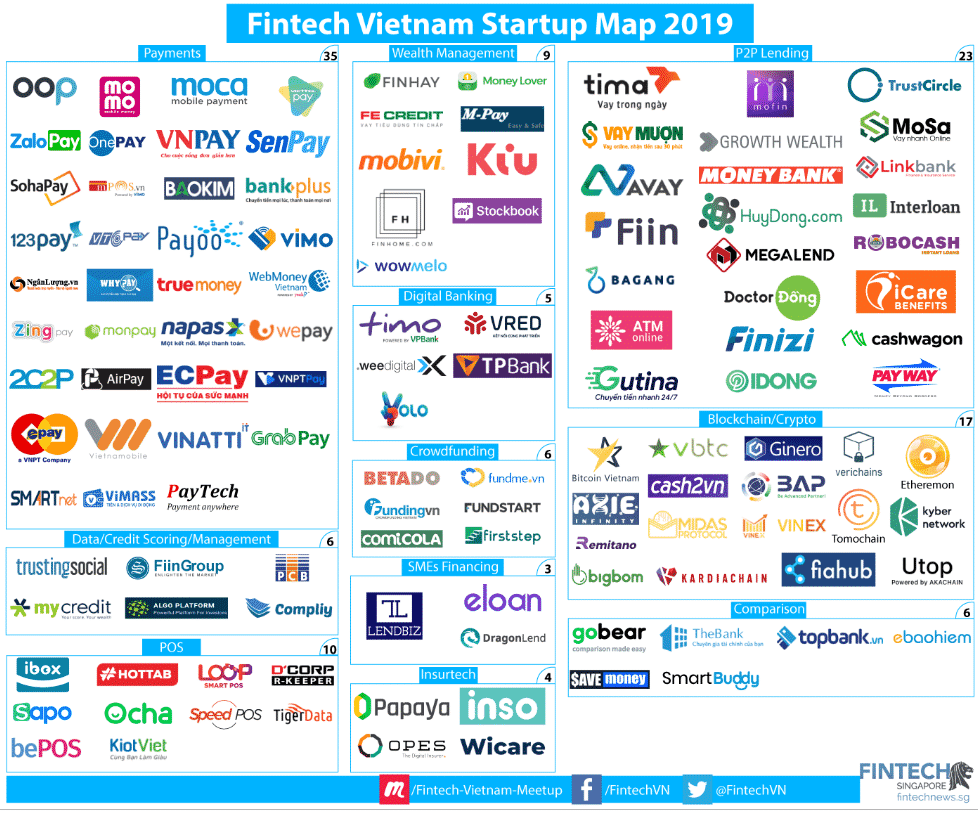

Fintech Vietnam Start-up Map 2019

Fintech Vietnam Start-up Map 2019

What is the impact of fintech?

Alter distribution channels and traditional financial services products

Altering the traditional product distribution channel is the most prominent impact of fintech. It’s created internet sales channels such as mobile banking, tablet banking, social networks, digital banking development, paperless processes,… Fintech has changed the transaction method and distribution channel in traditional finance.

Provide diverse services to users

In addition, services are provided such as payment, lending, money transfer,… Fintech also provides more extensive services such as peer-to-peer lending, crowdfunding, personal finance, data management, insurtech, crypto blockchain, etc. So, fintech services can meet more and more customers’ needs.

Collect big data

Financial technology can help collect and analyze large amounts of customer data. Through the collection of big data, financial bankers can reduce staffing costs and understand their customers better. At the same time, it helps improve service quality and customer satisfaction.

Financial and banking activities are fast and economical

Financial technology can change the whole market structure and product structure and simplify human labor. The trend of “paperless banks” helps financial transactions be quick, transparent, and economical. In addition, it also ensures safety and minimizes risks for customers.

Creating competitiveness through technological superiority

Today, banks and financial companies are strictly competitive to get more customers. Fintech technology is the competitive advantage of banks. The leading unit of fintech technology applications will achieve more success and profit. More and more banking start-ups can compete with big players based on fintech technology advantages.

Innotech Vietnam always strives to meet the needs of customers with the highest quality products and services. So we have received trust from big companies such as ACB, Tyme Bank, Unifimoney, Manulife, Commonwealth Bank, etc. to use products created by Innotech Vietnam.

If you are looking for a Fintech Outsourcing company to provide solutions for your company,. Contact experts at Innotech Vietnam for any questions about Fintech software Outsourcing!

Contact us: Innotech Vietnam

Share your information

[hubspot type=form portal=6619918 id=b4a8f47d-4168-452e-bb6a-9012b6fd35b9]