In Vietnam, the number of software companies is increasing day by day. However, providing eKYC solution in banking and finance, only a few companies can deploy well.

What will the eKYC solution bring to banking and finance industry?

eKYC solution bring countless benefits to banking and finance

eKYC solution bring countless benefits to banking and finance

Technology has really exploded into the financial and banking sector with the countless benefits it brings. We can see the combination of technology to bring the best experience to customers as well as savings for businesses very effectively.

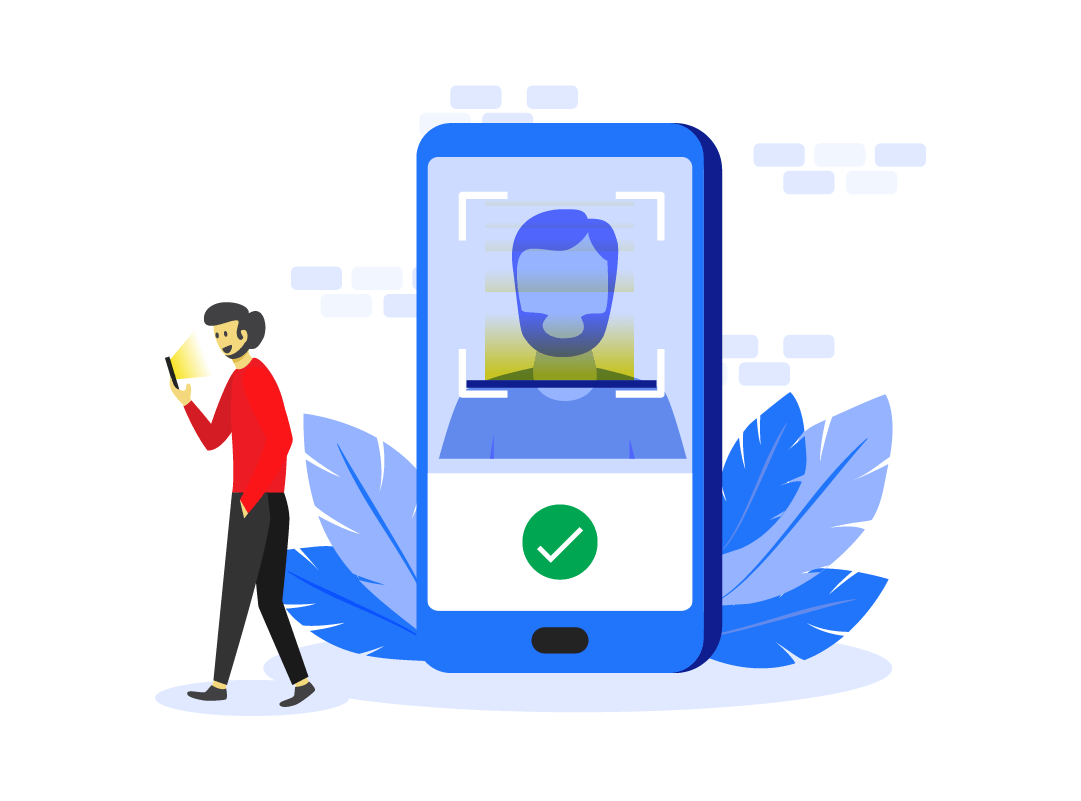

For traditional banks, when you need to register the card or register for services, you must go directly to the bank and provide your ID documents. At that time, the bank will collate the image on your ID card with your image in reality by selfie. The process of making such a declaration takes a lot of time for customers as well as service providers. Sometimes, wrong input leads to unnecessary problems later.

With eKYC solution brought in this field, customers can register to open a bank account, open a membership card or register for services online or through their smartphone.

Apply OCR process in Vietnamese banks and finance companies

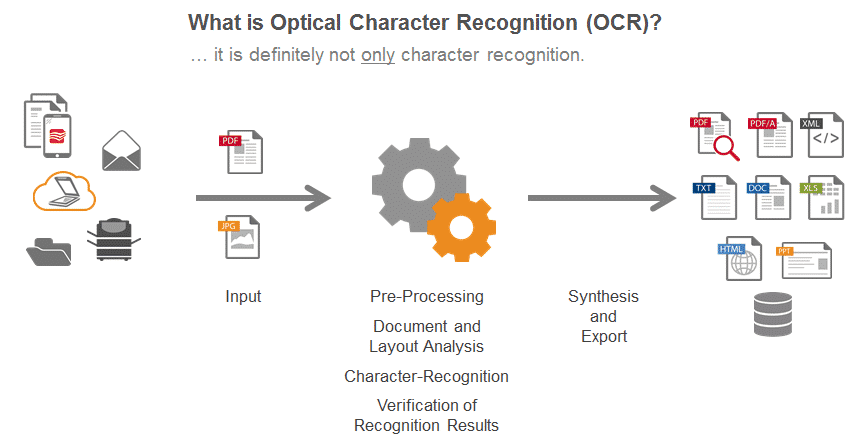

Optical character recognition (OCR) technology was born in the 90s of the last century and has been widely applied in many important areas around the world. Banking is one of the largest fields that OCR combined automation technologies today. Using OCR in banks has created a revolution of document digitization taking place at a high speed and large scale, reducing the load of a large amount of administrative work.

ORC process application

Today, everyone is too busy to go to the bank, so you can sign up quickly and easily online anywhere.

Stage 1: First, you’re asked to take a photo of your official ID document. You can choose a passport, driving license, ID card. Then, you just pick it up in the system.

Stage 2: Next, that digital image of your document is uploaded and checked against their identity document template database and verified. You’re required to take a selfie, that is compared against the photo on ID document using biometric technology.

Stage 3: If service providers trust in your identity, your ID data will fill in all of your details automatically. Finally, you’re signed up online and become a new customer.

Optical character recognition (OCR) process operation

Optical character recognition (OCR) process operation

eKYC solution at Innotech Vietnam

Innotech Vietnam Corporation with over 12 years of experience in providing software development services to large corporations around the globe. Focusing on developing digital transformation platforms and solutions that help businesses accelerate digital transformation, improve competitiveness, develop new business models to become the market leader.

eKYC Vietnam has not been widely implemented in financial and banking systems. Taking this opportunity, ITV supports banks to integrate eKYC solution into their system.

TẬP ĐOÀN INNOTECH VIETNAM is confident in developing eKYC service in banking and finance. From the OCR process, ITV has expanded to provide more solutions in case customers want to borrow money or open credit cards at banks and financial institutions. This is one of the banking services that require a long time to verify.

Inheriting from the OCR process, ITV has developed a solution where customers who want to borrow money or open credit cards need to consider more aspects. In addition to ID cards, customers need to provide relevant documents to support verification such as proof of financial ability and identity of relatives.

- Image processing: In addition to checking images on paper compared to the portraits you provide. ITV developed liveness detection technology, ensuring the high accuracy of participants’ service registration.

- Character Processing: The software will extract the customer information and fill in the registration information form correctly.

- Request review: When you have completed the two steps above, the software will check you on transaction history, credit history at the Credit Information Center (CIC) of the State Bank organization. And consider whether you are eligible for the service or the limit you can borrow based on each bank’s standards.

eKYC solution for banking and financial institution was developed by Innotech Vietnam

Innotech Vietnam always strives to meet the needs of customers with the highest quality products and services. So we have received the trust from big companies such as ACB, Tyme Bank, Unifimoney, Manulife, Commonwealth Bank,…to use products created by Innotech Vietnam.

If you are looking for a Fintech Outsourcing company to provide solutions for your company. Contact experts at Innotech Vietnam for any questions about Fintech Software Outsourcing!

Email: [email protected]