Vietnam is an increasingly connected country, and so it is a natural fit for the development of Fintech companies. Thanks to its young demographic, strong e-commerce growth, increasing smartphone and internet users lead to it becoming a great potential market for Fintech developers.

Vietnam’s Fintech startup landscape

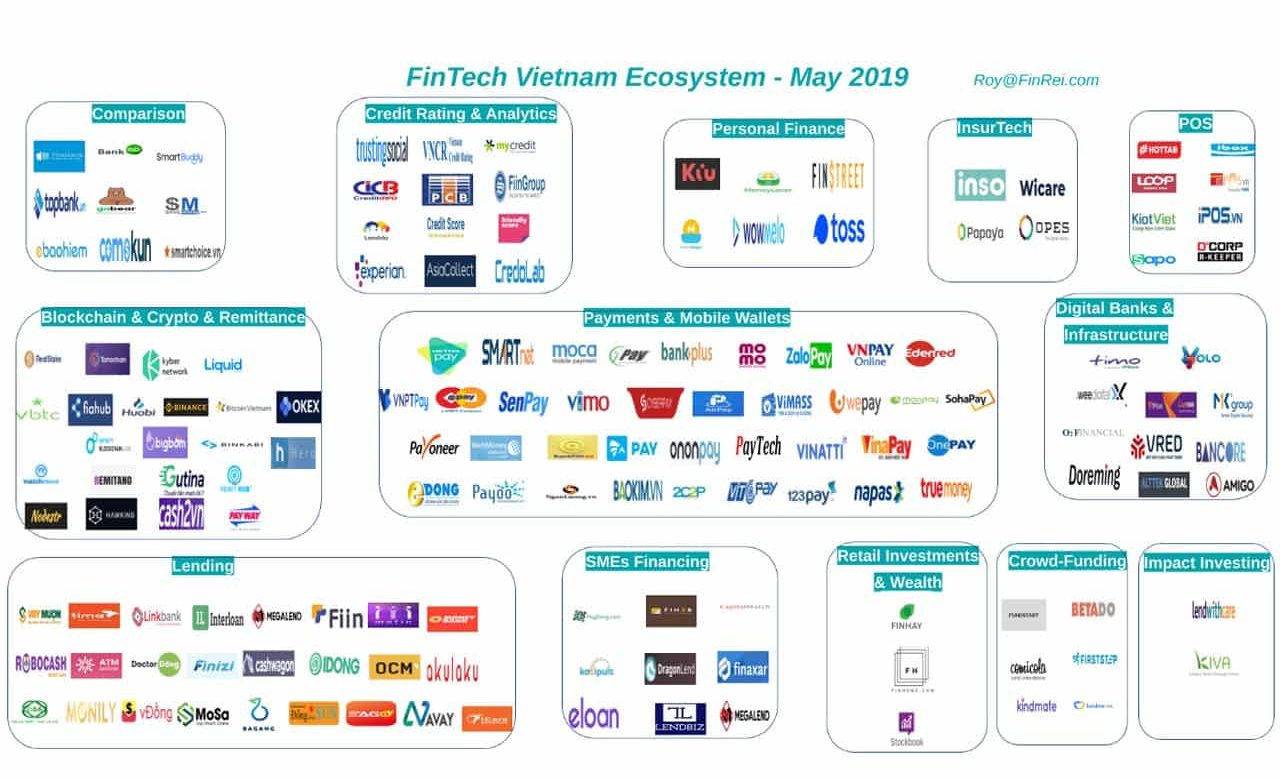

On the one hand, following Ernst & Young (EY) report in 2018, 90 percent of transactions in Vietnam are conducted in cash, and this has led Fintechs to focus primarily on the development of payment services. Therefore, around 47 percent of Vietnamese Fintech startups are only focused on payments, the highest rate in the region. As of September 2019, there were 136 Fintech companies incorporated in Vietnam. Following a report by Casey Hynes on Forbes, the total investment in Vietnam’s Fintech market will reach $7.8 billion by 2020. Besides, the Vietnamese government created an “increasingly supportive regulatory framework” via the creation of SBV Steering Committee on Financial Technology.

There were 136 Fintech companies incorporated in Vietnam.

There were 136 Fintech companies incorporated in Vietnam.

On the other hand, according to the recent speech of Pham Xuan Hoe, Deputy Director General of the Banking Strategy Institute at the State Bank of Vietnam at “Shaping the future of Vietnam Fintech” conference, there are over 143 million phone subscriptions, 45 percent are for 3G and 4G services. Also, a report published in late 2018 by Allied Market Research estimated that the Vietnamese mobile payment market could reach US$70,937 million by 2025. In particular, payments through mobile banking services have surged to 144% per year over the past five years; transactions over mobile apps and digital wallets rose by an impressive 126% and 161% respectively. It shows that there are more and more opportunities to develop and diverse Fintech services/products as well as creating a non-cash economy shortly. There is one thing that cashless payments are irrefutable booming in Vietnam, more than doubling in value over the first three quarters of 2018.

Benefits of choosing software outsourcing for Fintech startups

To succeed, FinTech startups must grow, execute, and innovate quickly. They often lack the staff, capital, flexibility, or risk tolerance to do so. Even if they’re newly funded, it doesn’t make financial or logistical sense to build all technologies needed in-house and from scratch. So what’s a FinTech startup to do?

1. SPEED TO INNOVATION (AKA ACCESS TO TOP TALENT)

Deloitte’s Global Outsourcing Survey 2018 sends a clear message: More and more businesses are using outsourcing to drive innovation, and it’s enabling competitive advantage. From 2016 to 2018, Deloitte saw an increase from 20% to 49% in the number of organisations moving services to outside providers as they innovate.

Innovation is the essence of Fintech. Fintech startups use both existing and emerging technologies (e.g., AI, blockchain, cryptocurrency, IoT, biometrics) to rethink and revolutionise financial services. Their success and competitive advantage depend on having the specialised knowledge needed to harness the power of these technologies. Where do they get it? By finding experienced, top-tier development talent to help them conceptualise and develop their solutions. Only startups who engage the most innovative, intelligent and creative development talent will succeed.

With US unemployment at the lowest rate in 50 years, that top talent isn’t exactly hurting for work. Newly funded startups often can’t afford the sky-high salaries required to attract these professionals, ending up with less-experienced professionals who can’t deliver. Over and over, the data backs this up:

- “CIOs across the board identify lack of skills and other human resources as their No. 1 barrier to success.” — Gartner’s 2017 CIO Agenda Report

- “Talent has now been recognized globally as the single biggest issue standing in the way of CIOs achieving their objectives.” — Gartner’s 2016 CIO Agenda Report

- 53% of respondents “hired tech talent who did not meet the job description requirements out of immediate need,” and 83% felt the tech talent shortage had hurt their business through “lost revenue, slower product development, market expansion, or increased employee tension and burnout.” — Indeed December 2016 survey

Outsourcing or co-sourcing software development talent removes this barrier to success, letting FinTech startups:

- Engage expert developers for only as long as they’re needed.

- Hand-pick the FinTech expertise and intellectual capital you need to drive success.

2. COST EFFECTIVENESS

The data also shows that outsourcing saves costs. In Deloitte’s 2016 Global Outsourcing Survey, 59% of respondents cited “cost-cutting” as a primary driver. When assessing how innovation creates value in outsourcing relationships, 44% pointed to reduced delivery costs.

With software outsourcing or co-sourcing, FinTech startups gain significant cost-related benefits, including:

- No need to pay the costs of recruiting and training development professionals (easily a $50k investment), not to mention their benefits, office space, and hardware/software, or the high costs of turnover

- No need to pay the hefty salaries required to keep experts on staff long-term

- Increased budget control/visibility, given clearly delineated scopes of work (SOWs) that outline your investment

- No paying for development downtime

3. IMPROVED FLEXIBILITY — AND REDUCED RISK OF A BAD FIT

The risk of a bad fit is considered when making hires central to development success. One bad hire could slow your progress or throttle your budget.

There are no guarantee professionals hired in-house won’t be a bad fit technically or culturally. And hiring specialized resources in-house can drain or strain capital that could be better used toward other strategic priorities. Countless startups (e.g., Slack, GitHub, Skype, Basecamp) have built their businesses using outsourced development talent they couldn’t afford full-time. Needing to ensure sustainable growth, FinTech startups are catching on.

Co-sourcing and software outsourcing offer massive flexibility and scaling benefits for FinTech startups, including:

- Ability to quickly scale delivery teams up or down to meet important goals/milestones

- No need to hire extra employees to try new frameworks or ideas — just request the right specialists from your outsourcing or co-sourcing partner

- Improved ability to flex your budget to fit evolving priorities

- No long-term commitment made to in-house employees who may be a bad fit

- Development professionals experienced in collaboration and communication, reducing the risk of a bad fit

4. INCREASED SPEED TO MARKET

Deloitte’s Global Outsourcing Survey 2018 asserts, “Today, disruptive outsourcing is about collaborating with partners in the marketplace to integrate services an organisation cannot quickly build on its own to innovate, transform, propel its growth, and unnerve its competitors”.

For FinTech startups, speed matters. You can’t let your competitors get to market faster, so you need to build, execute, and innovate more efficiently than they do. As McKinsey echoed in its 2018 “Ten trends shaping fintech,” “The most successful fintech have evolved into execution machines that rapidly deliver innovative products.”

Outsourced or co-sourced arrangements offer significant speed advantages:

- Ability to quickly source top-tier development talent with proven experience on similar projects — without being slowed down by recruiting, hiring, and onboarding

- Less ramp-up time and faster progress, given their familiarity with similar projects and efficient, time-tested processes

- Potentially having team members in multiple time zones, ensuring continued progress while you sleep

5. IMPROVED QUALITY

As a FinTech startup looking to disrupt, can you afford to gamble on the quality of your development team’s work? Capital is not inexhaustible. Investors need to trust you’ll deliver, or funding will dry up. Partnerships with financial services incumbents will be at risk if your work’s quality or reliability is in question.

Working with a software outsourcing or co-sourcing partner is a huge help here, too, because:

You can choose a partner with a track record of award-winning FinTech products with millions of satisfied users. They’ll already know your industry and business landscape. Their proven expertise on similar projects means increased quality, speed to market, and flexibility for your product.

Conclusion and Further outlook

The government of Vietnam has special tax schemes for start-ups under certain conditions.

The government of Vietnam has special tax schemes for start-ups under certain conditions.

Vietnam is a promising market for Fintech start-ups due to the government’s support in helping to foster it. The government established the National Agency for Technology Entrepreneurship and Commercialisation Development (NATEC) in 2016. NATEC is a platform under the Ministry of Science and Technology which aims to provide training, mentorship, business incubation and acceleration and financial aid to new technology start-ups. Moreover, The government of Vietnam also has special tax schemes for start-ups under certain conditions. It will provide corporate income tax breaks for companies working in the high technology sector or high-tech zones. The preferential tax rates are 10 % for 15 years or 17% for 10 years, as opposed to the regular rate of 20%.

In the future, the government would continue developing a positive legal framework to facilitate Fintech development services across the country.

Innotech Vietnam always strives to meet the needs of customers with the highest quality products and services. So we have received the trust from big companies such as ACB, Tyme Bank, Unifimoney, Manulife, Commonwealth Bank, … to use products created by Innotech Vietnam.

If you are looking for a Fintech Outsourcing company to provide solutions for your company. Contact experts at Innotech Vietnam for any questions about Fintech software Outsourcing!

Email: [email protected]